Written by Andrew Neal on Aug 1, 2023

5 Strategies for Optimizing the Patient Financial Experience

For patients, navigating through the complexities of a healthcare visit shouldn’t end with a stressful payment experience. A swift, accurate, and seamless billing process not only improves their post-care experience, but also fosters trust in you as their healthcare provider.

As industry expectations evolve, many healthcare providers lag behind the expectations of their patients, risking their market competitiveness. Here are five strategies to help revenue cycle leaders provide an exceptional patient financial experience.

1. Simplify and Broaden Access to Patient Financial Services

To enhance the patient financial experience, healthcare providers should prioritize simplicity and accessibility. Implementing a user-friendly online payment option, such as a patient portal consistent with your organization’s look and feel, allows patients to conveniently pay their bills from anywhere at any time. The rise of digital platforms has driven an increase in online payments, with a recent Salucro survey revealing that 62% of patients pay their healthcare bills via patient portals.

It’s important not to overlook simple remedies. For example, providers should prominently display clear instructions on their website, at the front desk, and in scripted phone interactions to help guide patients through the payment process.

By offering flexible payment options, such as credit and debit cards, healthcare-specific third-party financing like CareCredit, or flexible recurring payment plans, you empower patients to choose the method that best suits their financial preferences.

2. Facilitate Multichannel Payments

While over half of patients pay their bills via patient portal, providers who offer a comprehensive and inclusive list of payment methods are in the best position to maximize their potential revenue streams and enhance patient satisfaction. Even as many patients’ preferences are trending toward a digital-first experience, 30% of patients still pay their medical bills most often by check or phone – highlighting the importance of offering a payment and billing experience that is prepared to meet all patients where they’re most likely to act.

Flexibility ensures your revenue cycle workflow caters to these preferences and helps to maintain a positive patient financial experience. It accommodates different patient demographics and empowers them to choose the most convenient and comfortable method for their payment transactions.

3. Encourage Online Bill Payments

Online bill payment platforms provide the convenience that modern healthcare consumers seek. It’s not just about facilitating online transactions; it’s also about making billing statements, account information, payment history, and balances easily accessible. Simple, effective communication channels within an online portal also allows patients to seek assistance and resolve billing-related questions promptly.

Transitioning to online bill payments can be beneficial for both patients and providers. With secure, digital transactions, providers can streamline their billing operations, reduce administrative costs, and improve accuracy by automating payment processing and eliminating manual data entry.

4. Enhance Patient Engagement

Implementing a variety of communication and payment options engages patients where they prefer and optimizes the billing process. For a cost-effective and efficient revenue cycle, patients must be involved and informed every step of the way.

Opting for a trusted third-party technology vendor to handle your patient engagement needs offloads in-house staff burdens while ensuring the security and confidentiality of patient data.

Providing digital billing experiences allows providers to offer advanced features that streamline billing processes. This includes generating and delivering electronic bills directly to patients, enabling secure online payment options, and providing real-time account information.

By leveraging a digital payment solution, healthcare providers can reduce paperwork, decrease the chances of lost or delayed bills, and improve overall billing accuracy. This enhanced patient engagement contributes to improved revenue cycle management by increasing payment efficiency and reducing outstanding balances.

5. Implement Flexible Payment Plans

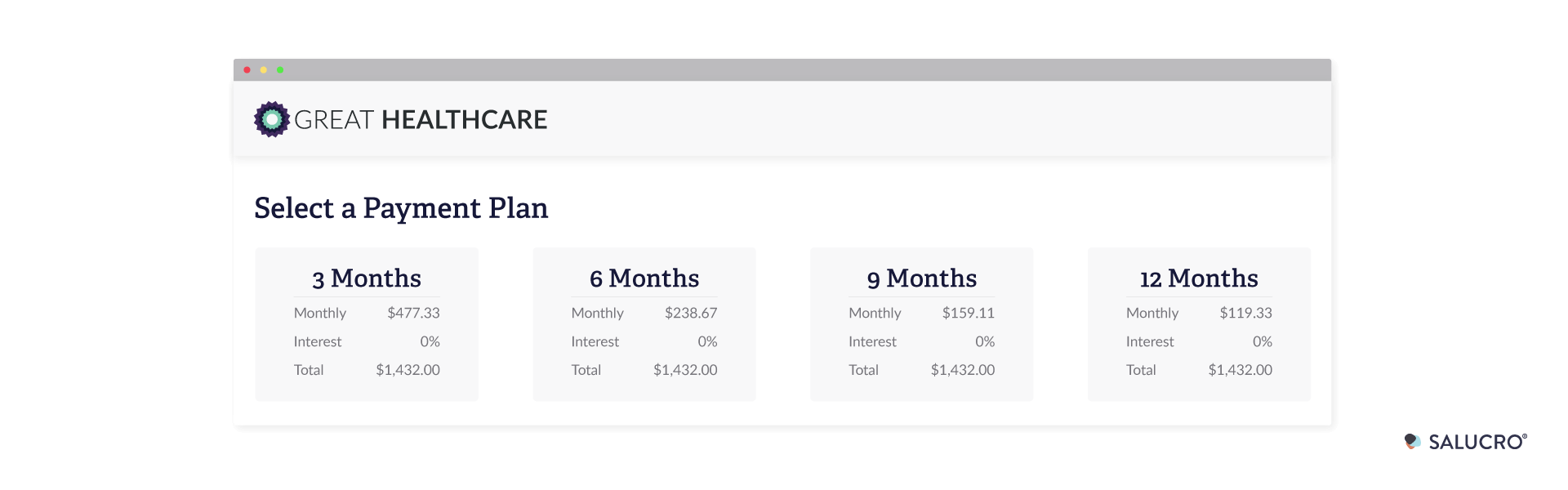

Providing flexible payment plans can alleviate the financial strain on patients who might struggle with making immediate full payments. By offering them more ways to address their healthcare bills, you help to prevent potential late fees and collection costs and reduce the risk of writing off unpaid debts.

Working collaboratively with patients to establish reasonable payment plans not only fosters goodwill and patient loyalty but also promotes financial stability for both parties. Salucro offers over 16 different payment options including access to third-party financing offered by qualified, healthcare-specific recourse and non-recourse lenders.

Salucro Patient Payment Technology

Today’s patients are more informed and expect an efficient, respectful financial service after their visit to a healthcare provider. Digital payment and engagement solutions are increasingly becoming the norm, and patients who cannot access such options are likely to experience frustration or look to other institutions who offer those services. By implementing these best practices, revenue cycle leaders can create a patient financial experience that champions patient needs, enhances satisfaction, and contributes positively to their organization.