Written by Yuriy Onyskiv on Apr 19, 2022

How to Create Personalized Financing Experiences That Meet Patient Needs

Are you concerned about patients delaying healthcare because they can’t afford it? If you haven’t considered the possibility, recent studies may put it on your radar. A recent CDC report revealed that over 40% of adults delayed or skipped medical care altogether due to an inability to pay, COVID concerns, or a combination of both.

What’s more, nearly nine in ten Americans say they are concerned about the increases in their healthcare expenses. And it’s no wonder with the state of consumer finances today.

The federal reserve report also shared that 25% of Americans could not pay their bills if they experienced unexpected expenses of $400 or more. With 46% of insured adults carrying deductibles more than double this amount, it’s no surprise that U.S. healthcare consumers worry about how to pay for their medical expenses.

And the 44% of the population who claim to be underinsured or uninsured are even more vulnerable to unplanned medical bills. Recent government regulations like the “No Surprises Act” and hospital pricing transparency will help consumers understand their bills, but many still will struggle to be able to pay their bills without access to some sort of financing option.

Affordability Remains Problematic for All Patient Financial Profiles

Before the pandemic, consumers had little wiggle room for unexpected expenses. Then COVID-19 happened, and things got even worse. The pandemic disrupted many people’s finances with substantial layoffs – especially those workers with less education. When seeking help from lenders, many consumers struggled with financial institutions – 29% of adults said they experienced issues when using banking or credit services.

Simply stated, whether patients are insured, underinsured, or uninsured, healthcare affordability remains problematic and top-of-mind for them. At least 24% of adults claim to have either struggled to pay their medical bills or have been unable to pay them at all.

Other industries, like automobile and retail, use short-term financing options to help consumers with affordability and improve loyalty. Is healthcare ready to adapt and meet consumers with a similar, more retail-like experience?

Incentivizing Personalized Financing Options with Consumers

With ecommerce advancements and rapidly evolving consumer expectations, there’s no better time than now to add personal financing options to a provider’s payment portfolio. With the right partner, technology, and process, healthcare providers can integrate short-term lending strategies directly into their billing process.

There is no doubt about it, the consumer affordability gap coupled with digital payment technology advancements will lead to substantial growth in personal healthcare financing in 2022 and beyond. Not only is financing the right thing to do for patients, it’s also good for business – and healthcare providers that don’t begin offering these services may be driving a wedge into their patient loyalty efforts.

As The Percentage of Healthcare Costs Shifts Toward Patients, The Need For Financing Will Continue to Grow

When providers meet their patients’ payment preferences, they get paid faster – according to our Patient Payment Technology Report, 65% of patients stated they would pay their balances faster if their payment preferences are used.

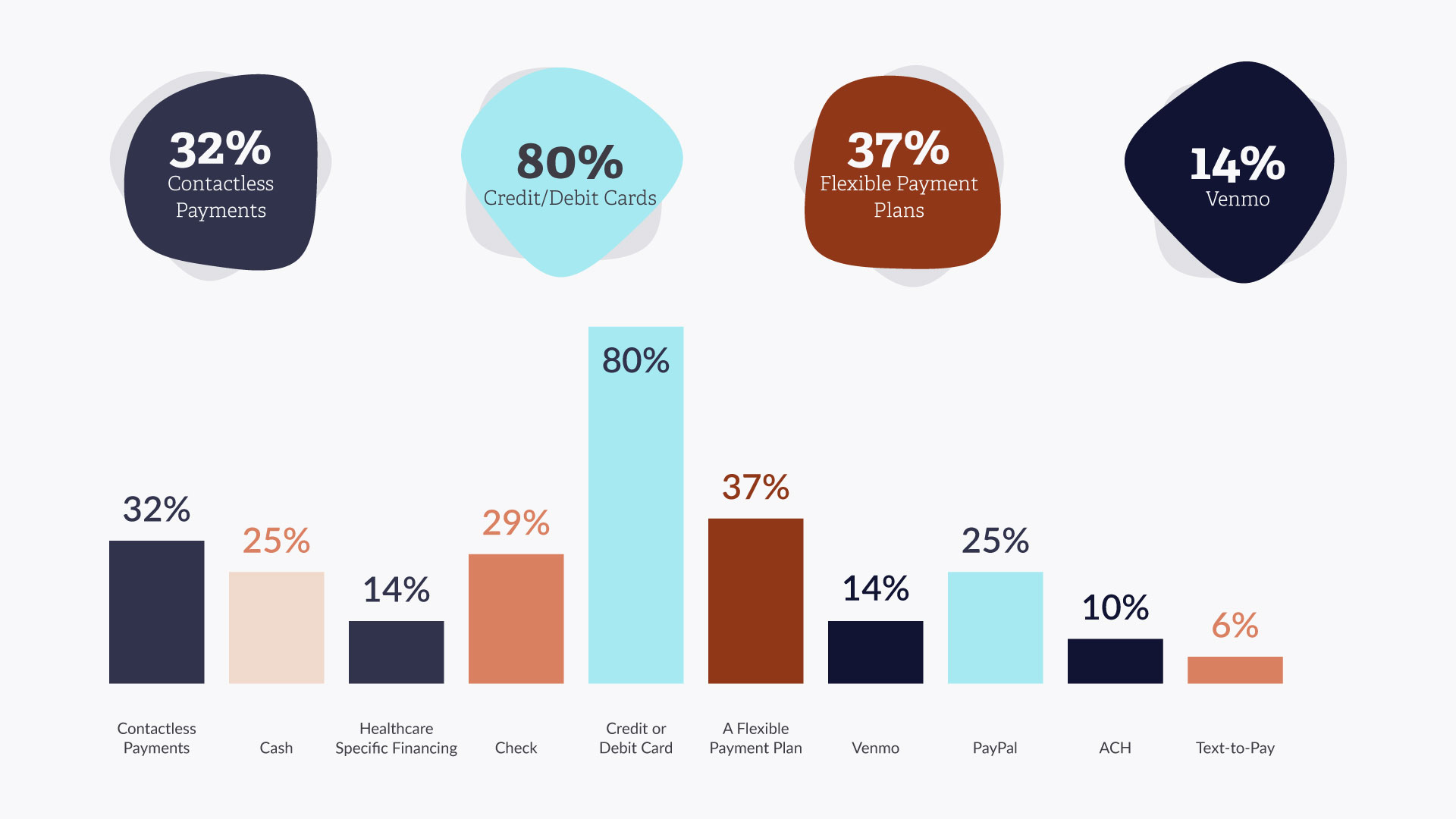

Some patients prefer contactless payments like Venmo, Zelle, and Apple Pay. Other patients want to pay over the phone. And some patients need access to flexible payment plans to help pay their high deductible.

With rising healthcare costs and the prevalence of high deductible plans, more consumers are looking for options to help them manage their out-of-pocket costs. In fact, when asked what type of payment options a patient would utilize if the flexibility was offered, 37% chose flexible payment plans, a 68% increase over 2019 survey results.

Most Americans have private health insurance, yet they do not have the liquid assets to pay the high deductibles and out-of-pocket costs associated with their plans. A serious illness or injury can result in thousands of dollars in cost-sharing requirements. Even small co-pays and coinsurance payments can add up over time. Patients spent an average of $1,148 on out-of-pocket medical expenses in the past 12 months.

Patients Need Personalized Patient Financing Options Now More Than Ever

Like it or not, patient demand for innovative, flexible payment options will continue to increase. In fact, the 2021 Patient Payment Technology Report shows that the payment and billing process greatly influences patient loyalty. Consumers are more likely to provide this loyalty when flexible online payment options are available.

The healthcare providers that proactively plan a strategy to meet and exceed patients’ demands will achieve greater patient engagement and loyalty. If providers ignore these preferences, they risk losing their patients to savvy competitors in the ever-expanding marketplace.

Patients want the ability to adjust the terms of their payment plans as well. According to the Salucro Patient Payment Technology Report 27% of patients surveyed needed a longer payment plan or financing terms to pay for their medical expenses.

With the ever-increasing deductibles and out-of-pocket expenses, patients need providers to expand their payment solutions to include patient financing options. Patient loyalty will depend on it.

Patients Want Easy, Flexible, And Low-Cost Financing Options

When it comes to financing healthcare expenses, patients expect similar features and benefits to the short-term lending and buy now pay later (BNPL) services that other industries offer. Some of these include:

- Early and consistent communication – It’s important to build an up-front process that educates all patients on their payment options, especially personalized financing.

- Simple and flexible payment terms – Healthcare providers should keep their financing plans simple enough for patients to understand and sign up via self-service applications.

- Low promotional interest rates – The payment financing option should be positioned as a service to patients, not a new revenue stream. Rather than incurring monthly fees, they can work with their providers similar to other retail programs.

- Easy access to line of credit – Once a credit amount is established, a patient should have easy access to the cash for healthcare expenses. They may need to add more expenses throughout the term of the loan.

- Access to real-time account balances – Patients expect immediate, online access to their accounts.

Healthcare providers can adopt simple and flexible lending practices to build consumer loyalty. By establishing themselves as clinical and financial partners, they can build long-lasting relationships with their patients.

Strategies to Launch Personalized Patient Financing

Healthcare providers need to begin delivering personalized patient financial experiences, allowing consumers to engage when and how they prefer from the security and convenience of their own devices. Patients expect providers to deliver more effective, seamless experiences across more payment channels. One of the ways providers can diversify their payment options is with short-term financing solutions.

Approaches to a more personalized patient financing offering may include:

- Robust Self-Service Digital Tools: An integrated digital healthcare payments platform, like Salucro, that enables self-service management of in-house payment plans, digital statements, and real-time account updates all from any device.

- Buy Now Pay Later (BNPL): Providers can get ahead of estimated high costs and develop payment plans prior to a scheduled service.

- Healthcare Credit Cards: Partner with a third party like CareCredit to offer zero to low-interest rate credit cards to patients who need to finance medical expenses.

- Reward Timely Payments with 0% Interest Rates or Lower Fees: With nearly 1 in 10 adults already owing medical debt, providers who offer access to more affordable financing will earn greater patient loyalty.

Not only will providers help their patients’ financial situation, but they’ll also positively impact their patients’ overall health and wellness. Patients will be less likely to delay or skip medical care due to the cost if they have a financing plan in place.

A critical step to building and implementing a personalized patient financing strategy is engaging a qualified third party to help you decide between offerings in the patient finance space. This allows providers to offer patients a customer-centric payment platform with a frictionless payment experience.

How To Identify the Right Payment Solutions Service Partner

Finding the right technology partner is critical when it comes to patient payments. Not only should a provider want a partner to build a personalized patient financing solution, but an overall payment solution strategy.

Healthcare organizations need to understand how to identify the right technology provider that can offer a more flexible approach to streamline the payment process; who can enhance payment security and limit the amount of sensitive payment data that goes through the healthcare revenue cycle system. A few considerations to make include:

- Advanced Patient Engagement: Does your technology partner allow you to engage patients through an on-demand channel with text alerts for new balances, payment reminders, and even give them the ability to make a payment directly through a text message with a saved card on file?

- Modern Payment Acceptance: Consumers have become accustomed to online checkout and mobile payment offerings, and providers need to engage patients with the payment types they prefer. It is important to find the right technology partner that can offer modernized payment options including access to third-party financing offered by qualified, healthcare-specific recourse and non-recourse lenders.

- Ability to Adapt: Can you facilitate patient payments across multiple accounts, locations, or systems with ease? The right technology partner can help ensure that regardless of the complexity, payments are auto-posted correctly, split effectively, and deposited into the correct account, reducing the burden on your treasury and revenue cycle teams.

In addition, providers should make sure their technology partner has deep experience working with a variety of healthcare customers. Payment technology can be complicated, and not all partners are equal when it comes to knowledge, experience, innovation, and industry qualifications.

In a time of increased healthcare expenses, greater patient financial responsibilities, and economic strain, patients need multiple payment options for their medical care. Now more than ever with over 40% of adults delaying or skipping medical care, they need your help to stay healthy–physically, mentally, and financially.